Battle for Q3 Supremacy: Solana vs. Ethereum - Who Will Prevail as Top Blockchain?

In the nuts and bolts of crypto, Solana's (SOL) recent tumble below $150 indicates a test of support levels, while Ethereum (ETH) is holding its fort at $2,500. The shifting SOL/ETH ratio paints a picture of crypto volatility that can make or break our digital assets.

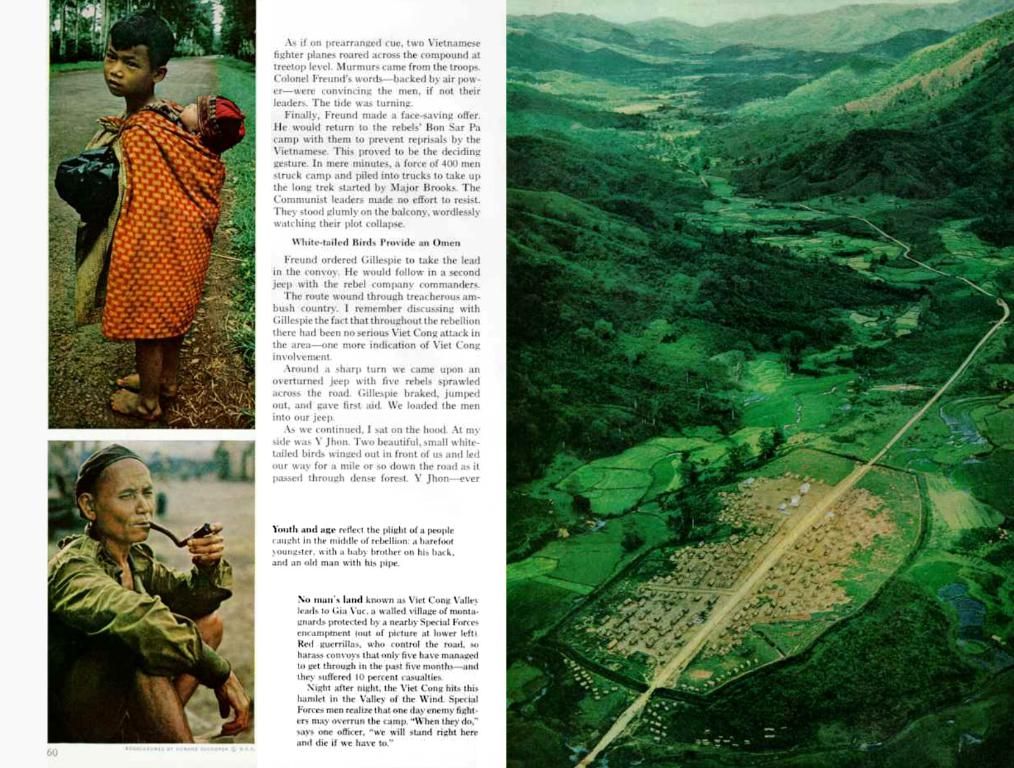

Solana's dive - close to 15% from the monthly highs - failed to hold the $150 fortress, sliding from its recent $180 territory. Ethereum, on the other hand, has been downright resilient, successfully batting away the $2,500 challenge.

This dance between the two contenders is also echoed in the SOL/ETH chart, hitting a four-month low this week, with a 5% drop that underscores Ethereum's strong showing. But it's not all one-sided; take a closer look, and you'll see Solana's support zones have sparked three spectacular reversal rallies since September 2024.

So, is SOL's recent skid the prelude to a structural shift, hinting at an impending deeper dump? Or is the cryptocurrency edging towards an inflection point ready to catapult sentiment back up?

Source: TradingView (SOL/ETH)

The SOL chart reveals the Relative Strength Index diving deep into oversold territory. A teeny 1.07% daily gain suggests there's relief brewing, adding to the bounce hypothesis.

But dig deeper, and the picture gets a bit murky, with on-chain metrics hinting at reversal. Daily Token Trading Volume surged by 14.9% for Ethereum to $11.7B, while Solana managed just a slim 9.1% rise to $2.3B. The gap widens further when it comes to fees, with Ethereum's Weekly Fees surging by 107.7% compared to Solana's scant 16.6% increase.

That signals stronger user activity on the Ethereum side, possibly pointing to greater conviction.

If we're looking at the calendar, we're just two weeks away from quarter-end, and the performance gap is widening. Ethereum has nearly a 40% Q2 lead, more than twice that of Solana.

Ethereum continues to enjoy strong investor confidence, firmly rooted and defending the $2,500 turf. Meanwhile, although Solana's technicals suggest a potential rebound, the big picture remains bearish.

So, will recent dips in SOL spell out buying opportunities or mark the beginning of a deeper descent? Time will tell, my friends. Time will tell.

Want more of our analysis? Don't be shy; subscribe to our daily newsletter and join the crypto conversation! Analyzing XRP's 4-day drop: Whales exit; is it time for retail to step in? | Bitcoin vs. Open Interest - Should traders be worried by THIS divergence?

- The recent drop in Solana (SOL) has resulted in a test of support levels below $150, while Ethereum (ETH) continues to hold at $2,500, highlighting crypto volatility and the shifting SOL/ETH ratio.

- The dive in Solana's price, close to 15% from monthly highs, failed to hold the $150 fortress, sliding from its recent $180 territory, contrasted by Ethereum's resilience battling the $2,500 challenge.

- The SOL/ETH chart has recently hit a four-month low and has a 5% drop that underscores Ethereum's strong showing, but Solana's support zones have sparked three spectacular reversal rallies since September 2024.

- The widening gap in Daily Token Trading Volume and fees between Solana and Ethereum, with Ethereum experiencing a more significant surge, signals stronger user activity on the Ethereum side, possibly pointing to greater conviction.

- If we're considering the calendar, Ethereum has nearly a 40% Q2 lead, more than twice that of Solana, suggesting continued strong investor confidence in Ethereum and a bearish outlook for Solana.