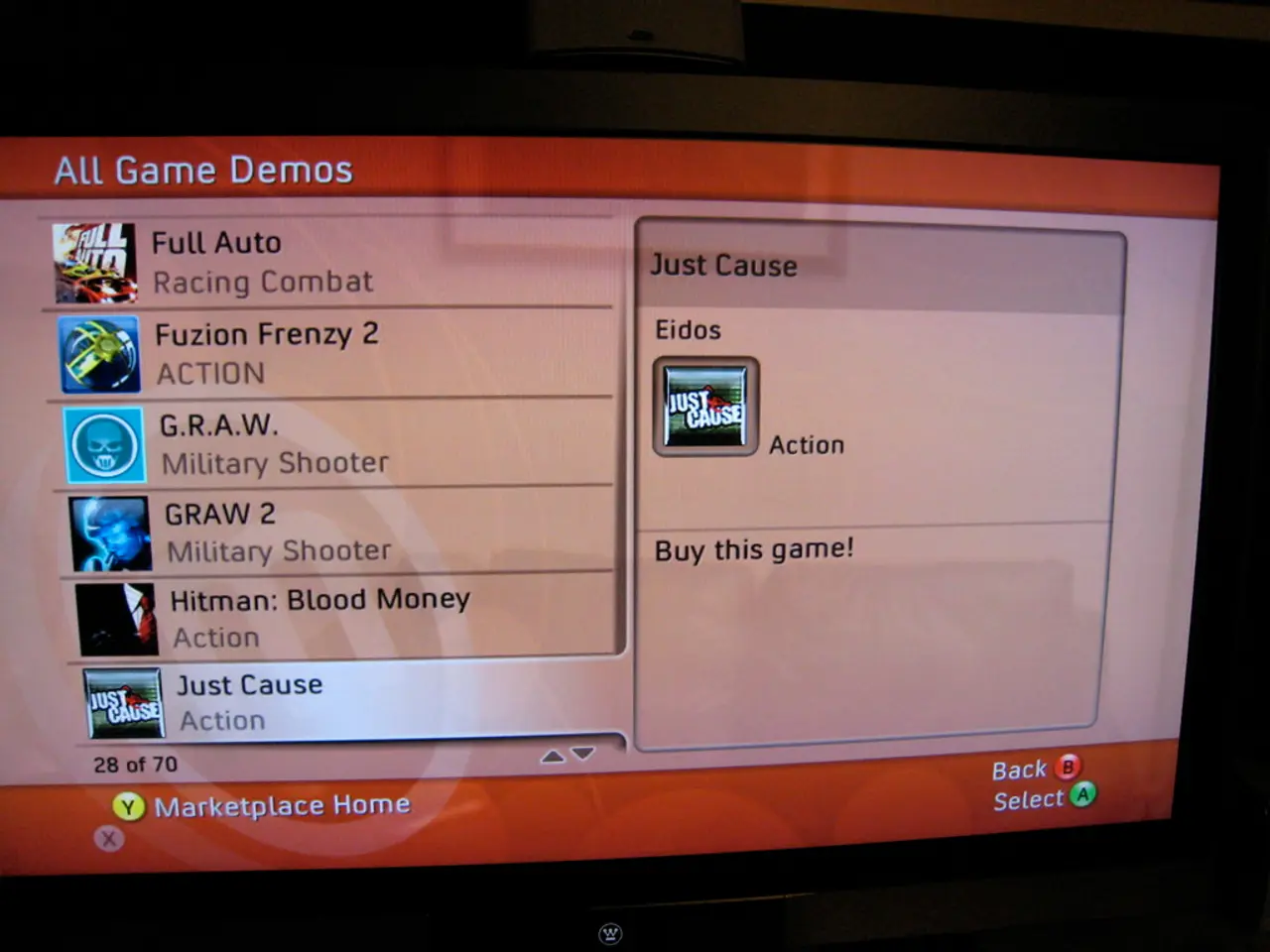

Strategic Analysis by Kettera - August 2020 Heat Map

In August, the world of hedge funds continued to show a mix of results across various strategies.

The Eurekahedge Long Short Equities Hedge Fund Index, as well as the Eurekahedge-Mizuho Multi-Strategy Index, reported positive performances for the month. The most profitable sectors and themes included yield curve strategies, long emerging market credit, and long commodities.

Systematic Trend Programs, however, showed a mixed bag for August, with most programs slightly negative on average. Profitable long positions in equities, long metals, and short USD were common in this category, but losses were particularly prevalent in fixed income and equity indices.

Metals & Energy Specialists, on the other hand, saw profits nearly across the board for both directional and spread traders. The S&P GSCI Metals & Energy Index and S&P GSCI Ag Commodities Index reflect this trend.

In Quant Macro, short fixed income positions were common among profitable programs. Equities markets, however, proved more profitable than commodities trades during the month.

Event Driven strategies saw several outliers to the upside in August. Despite Kettera Strategies reporting a positive performance in July for discretionary macro strategies, August was more muted for the firm, with specific sector or theme performance for that month unavailable.

Short-term & Higher Frequency Traders suffered losses in August, primarily from fixed income and equity indices.

The BarclayHedge Currency Traders Index and BTOP FX Traders Index, along with the CBOE Eurekahedge Relative Value Volatility Hedge Fund Index, also saw mixed results.

Lastly, the Bloomberg Galaxy Crypto Index and the Eurekahedge AI Hedge Fund Index were not specifically mentioned in relation to August performances.

It's important to note that the views expressed in this article are those of the author and not necessarily those of AlphaWeek or its publisher, The Sortino Group. This review aims to provide a general overview of the hedge fund landscape in August 2021, but for detailed and verified information on specific strategies and sector performances, proprietary performance reports, industry databases, or the hedge funds' own publications would be the best sources.

Investors exploring technology-focused sectors within the realm of finance might find opportunities in Quant Macro strategies, as they often involve short fixed income positions and have shown profitability in equities markets. Furthermore, investing in systems that specialize in metals and energy could yield returns for both directional and spread traders, as this category saw profits nearly across the board in August.